Customer Relations: Keeping track of NAR can highlight problematic customers or patterns, enabling better credit management and customer relationship strategies.Ĥ. Credit Policy: Monitoring NAR regularly can help evaluate the effectiveness of a company’s credit control policies and make any necessary adjustments.ģ. Cash Flow: A high NAR implies that more customers are paying their bills and ensures steady cash flow, allowing a company to meet its obligations smoothly.Ģ. Once you have calculated net accounts receivable, it is crucial to understand its implications on your business:ġ.

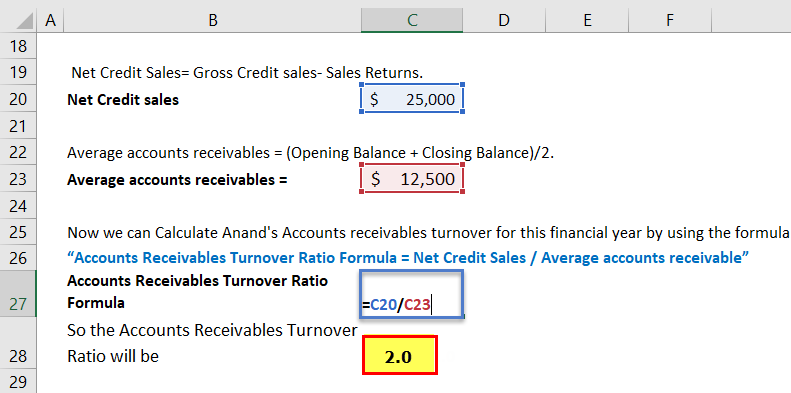

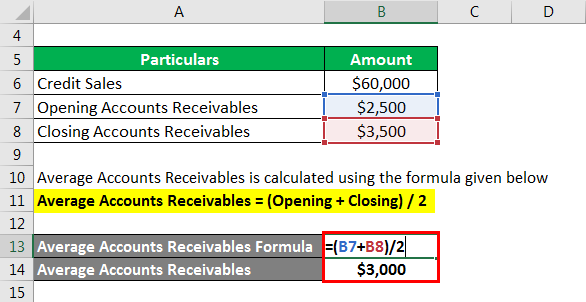

Net Accounts Receivable (NAR) = Gross Accounts Receivable – Allowance for Doubtful Accounts Subtract the estimated allowance for doubtful accounts from your gross accounts receivable to arrive at the net accounts receivable figure. Step 3: Calculate Net Accounts Receivable You may use methods such as percentage of sales, ageing schedule analysis, or any other suitable method to estimate this figure. Therefore, estimate an allowance for doubtful accounts based on past records or industry standards. Step 2: Estimate Allowance for Doubtful Accountsīusinesses need to understand that not all outstanding invoices may be fully collectible. Sum up these unpaid balances to calculate your gross accounts receivable. Gather all outstanding invoices owed by your customers as of a specific date. Step 1: Determine Gross Accounts Receivable To calculate net accounts receivable, follow these simple steps: It establishes the actual amount that a company is likely to collect from its customers, thus providing a clear understanding of its cash flow and the effectiveness of its credit control policy. Net Accounts Receivable (NAR) is the amount remaining after deducting doubtful accounts or bad debts (uncollectible accounts) from the total accounts receivable. The Sum of outstanding invoices represents the total accounts receivable, which forms an essential component of a company’s balance sheet. This article will guide you through the essential steps to calculate net accounts receivable, ensuring you have an accurate measure of your business’s liquidity and credit management capabilities.Īccounts Receivable (AR) refers to the outstanding invoices or money owed by customers to a business for goods or services provided on credit. One such vital indicator known as Net Accounts Receivable (NAR) plays a significant role in assessing a company’s cash flow and overall financial health. Managing a business’s finances depends heavily on accurately measuring and monitoring key financial indicators.

0 kommentar(er)

0 kommentar(er)